A Tale of Two Analysts

As reported by MSN and others, two Wall Street analysts clashed in April over whether AI is the problem or answer to Salesforce stock performance. An analyst from D.A. Davidson thinks Salesforce is neglecting its core product with the relentless focus on AI, while over at Bank of America they are of the opinion it will help to drive growth.

The charge of neglect feels like a serious one, so I decided to take an incredibly unscientific look at whether it held water. I was working my way through the Summer ‘25 release notes for the Credera webinar (sign up here if you haven’t already) and decided to see how they stacked up against previous releases using the following methodology:

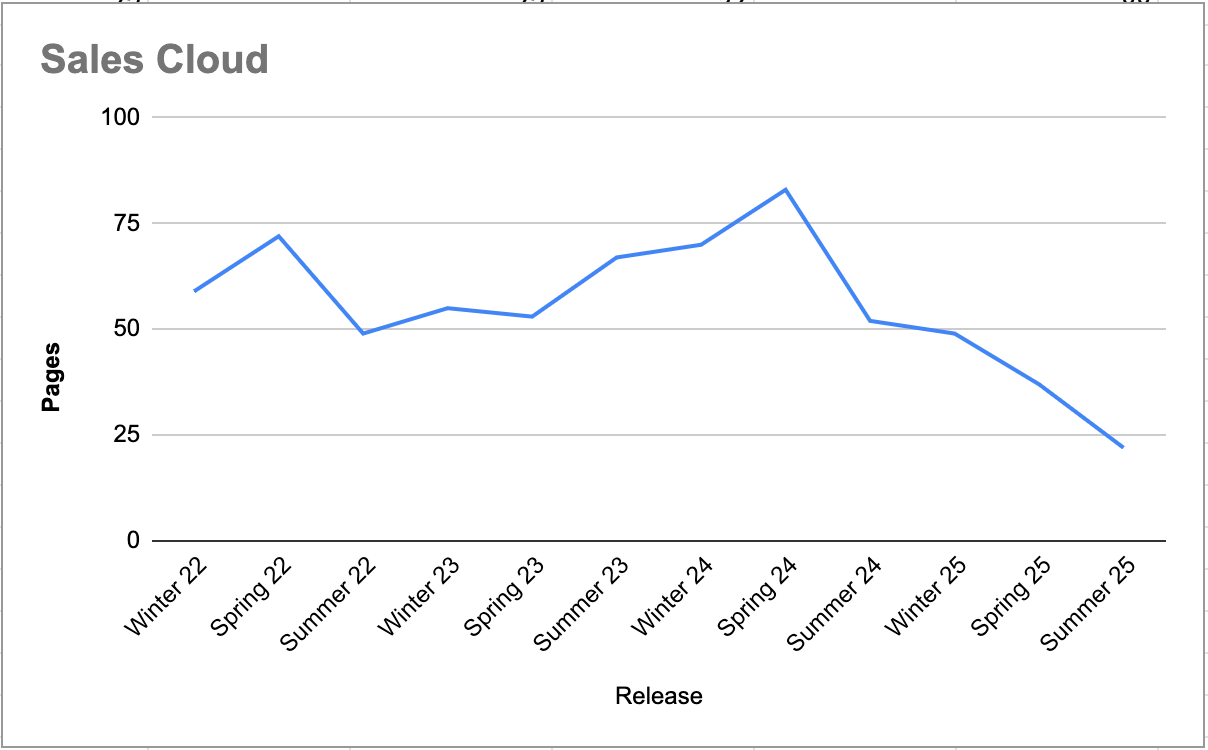

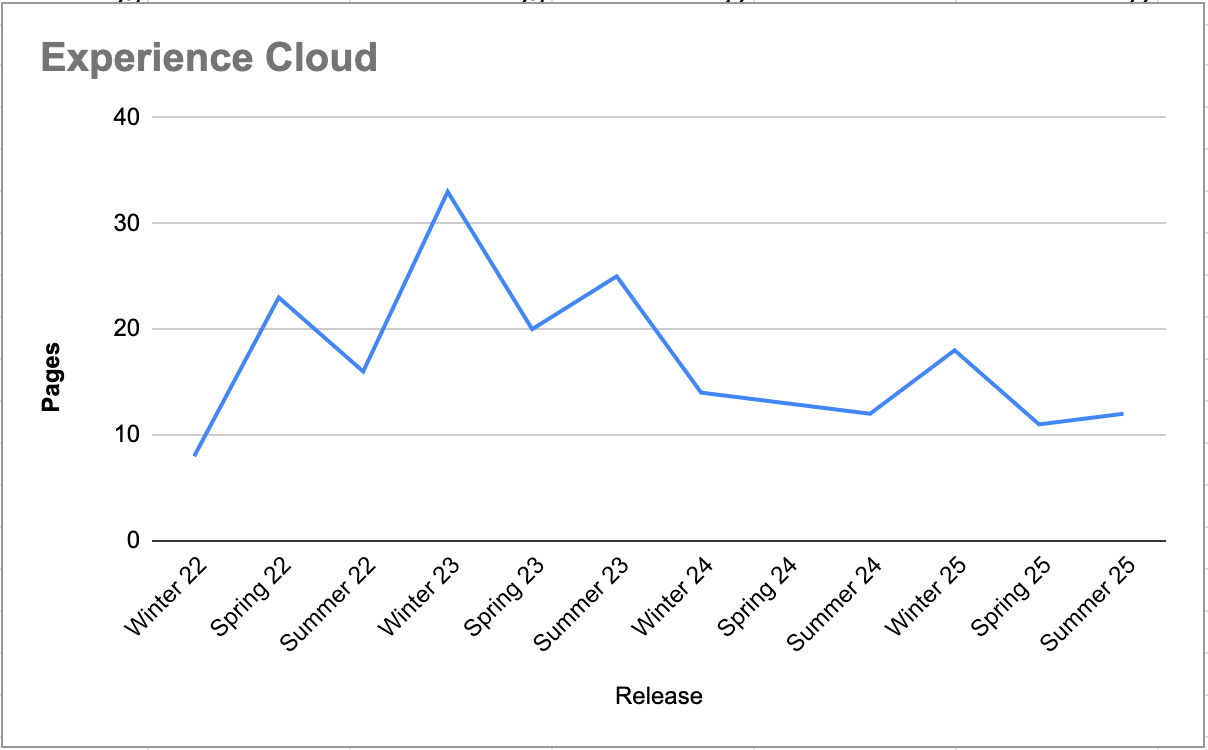

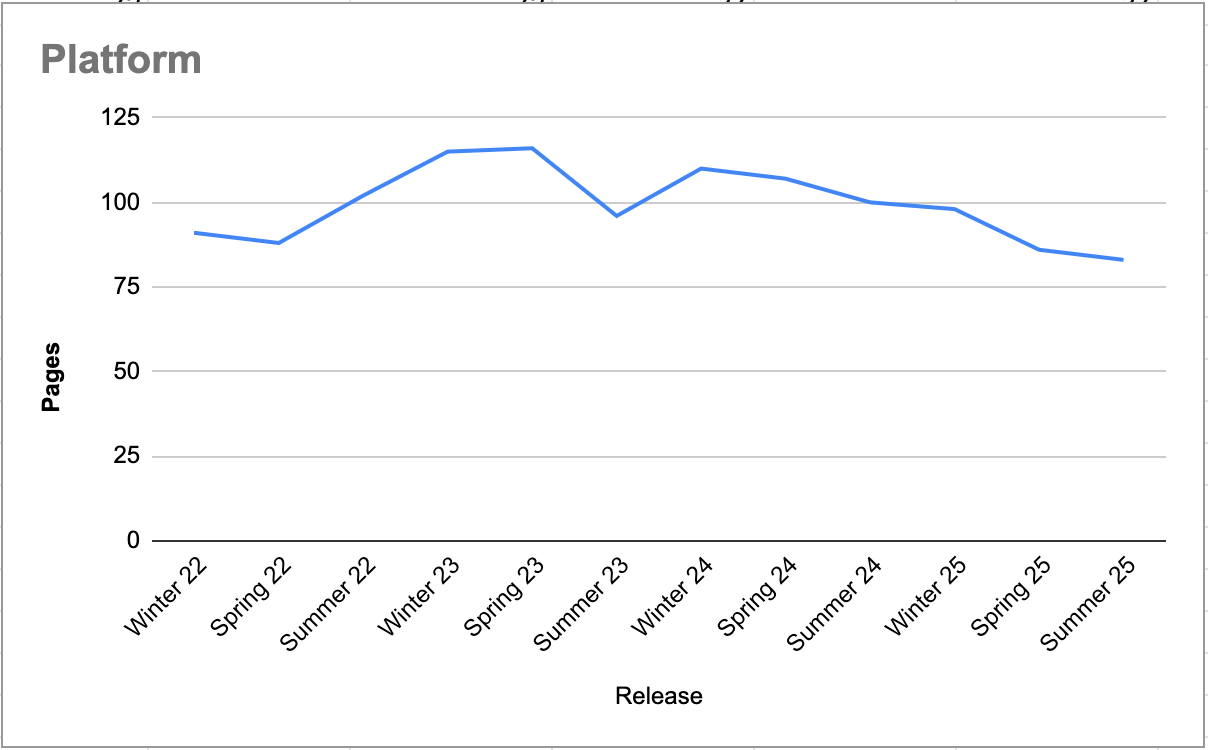

Use the release notes from Summer ‘25 back to Winter ‘22 - this predates even AI Cloud so should be a good baseline.

Sales, Service and Experience Cloud - count the pages dedicated to these clouds in the release notes and subtract the pages for Agentforce/Copilot/AI Cloud

Platform - combine the pages for customisation and development, and subtract the pages for Agentforce/Copilot/AI Cloud

Told you it was wildly unscientific didn’t I? In fairness though, I’m not sure how I could make it scientific given that I don’t work for Salesforce and I’m not involved in their development/product management. I guess I could look at the features and try to figure out how much effort went into each one, but without any insider knowledge of the implementation it would just come back to my opinion again.

Here are the results:

As you can see, it doesn’t look like Salesforce is neglecting the “core” clouds. Yes, the numbers have tailed off a bit, but they are still mostly at or above where they were 3 years ago, aside from Sales Cloud which appears to have taken a pasting in the last two releases.

Based on this terrible study, it feels like neglect is too strong a word, although Salesforce are clearly prioritising AI over pretty everything right now. And I think they are right to prioritise AI; Google I/O had a clear focus on AI, and after attending Microsoft Build Gergely Orosz had the following to say:

If Salesforce was bucking that trend it would likely be seen as a misstep. This is one of those situations where you can’t do right for doing wrong.

Agentforce Pricing Changes (Again)

Let me say right from the start that I think Salesforce should be commended for this change - they've listened to their customers, heard that pricing is difficult to understand and have changed it. This won't be entirely altruistic, as confusion around pricing was no doubt impacting Sales and adoption, and I’m sure some of the 1,000 new AEs pushing Agentforce fed that back, but let's take the charitable view.

Flex pricing is tied to the Agent taking actions - the more it does, the more you pay. You can buy 100,000 Flex credits for $500, working out to a snip at the price of half of one cent per credit. You don’t spend credits individually though, each standard or custom action consumes 20 Flex credits and costs you $0.10 - much better than $2, especially if the Agent can’t do much to help.

This approach does seem more aligned to outcomes - if the Agent is executing actions then that sounds like it’s doing valuable work. That may not always be the case though - for example,

They've also left the existing conversation-based pricing model in place for customers who felt it worked for them (all three of them!), which is another good move. You can’t mix and match conversation and Flex pricing though, and if you were thinking that might be the way forward I’d suggest it’s time to have a word with yourself.

The action-based nature of the new charging model makes a lot of sense to me, and the granularity that one action equals 20 credits adds much needed clarity compared to the old model of packaging credits into conversations that hardly anyone seemed to understand. Of course it's never that simple, as the concept of an action is based on 10,000 LLM tokens so it's possible to incur a cost multiplier on a single action if using large prompts or sending significant amounts of data to the LLM. Send 10,001 tokens and you’ll get charged for 2 actions (or $0.20), 20,001 you’ll get charged for 3 ($0.30) and so on. It feels like one of the jobs AI won’t take is tuning requests so they consume an exact multiple of 10,000 tokens and give the best return on investment. A key takeaway here is to make sure you understand what the prompts actually look like in production with real data - we've all encountered more data than expected in the past, but now instead of a limits breach we'll get a bill!

Which brings me back to my standard gripe about the various approaches Salesforce have taken to pricing - I’ve not got enough control. Yes I can set up flows that alert me when my consumption goes over a threshold, but I can’t automatically turn my Agents off if they are consuming more than I expected, instead I’ll rack up overages at 1.25x the contracted rate. Ideally I’d want a way to configure Agent throttling, so that if they are being subjected to some kind of misuse or just a really fast market, I can get them to back off and handle fewer requests while I get on top of things. I guess I just don’t want my Agents to be that autonomous, especially when they are spending my money!

Aside from my gripes, this won’t please everyone because it’s not possible to have a single pricing approach that works perfectly from SMB through to multinational corporation. Realistically Salesforce have to land on the least worst solution that gives them the revenue they want and annoys the fewest customers. Again, you can’t do right for doing wrong.

Columbo Close

Just one more thing. As I was about to hit publish the news broke that Salesforce had entered a definitive agreement to acquire Informatica. First thoughts are that this is all about helping customers provide clean data to AI Agents, and 22k+ connectors will no doubt come in handy. There’s also the little matter of 5,000 odd enterprise customers that probably won’t completely overlap with the Salesforce client list. Of course we won’t have to worry about this for 12-18 months, maybe longer if there are antitrust concerns, given Salesforce already own Mulesoft. Feels like there will be some layoffs once the businesses are combined, as multiple integration services probably isn’t something Salesforce are looking to offer.

One thing we do know is that while it’s taken 2 years, Marc Benioff is back on the multi-billion dollar deal trail - I wonder if the M&A Committee has been reformed.